Key Points

- In the materiality assessment, all ESRS 1 sustainability topics are assessed on how relevant they are to your company.

- Each topic is assessed according to its financial and impact materiality. Should it be deemed “material” in one of the two categories, it must be disclosed in line with the Corporate Sustainability Reporting Directive (CSRD).

- The results reveal action and transformation potential that can then be used to gain a competitive edge when it comes to sustainability.

A mandatory part of the CSRD report

The introduction of the Corporate Sustainability Reporting Directive (CSRD) in the EU means that 49,000 European companies will be obliged to submit an annual sustainability report in the future. Preparing for the CSRD report requires various steps. One of the main parts of the CSRD report is conducting a materiality assessment. The aim of the assessment is to identify all sustainability topics that are relevant for the report. Conducting the materiality assessment is a mandatory part of the CSRD report.

Is the materiality assessment just a tedious obligation?

As already mentioned, the aim of the materiality assessment is to determine the topics that are relevant to the report. This is based on the concept of double materiality, which is made up of financial materiality and impact materiality. Each sustainability topic is assessed according to both aspects. As soon as it is classified as material in one aspect, it is considered reportable. The European Sustainability Reporting Standards (ESRS) specify the topics that companies must assess.

Financial materiality: The financial risks and opportunities that could affect your business are assessed.

Impact materiality: The actual or potential impact of a company‘s own business activities on society and the environment are assessed.

We recommend not simply seeing the materiality assessment as something that has to be done, but also as an opportunity to understand your business better, evaluate your own company processes and find out what opportunities and risks can be expected. The knowledge that companies gain from conducting this assessment can be used as a basis for sustainable transformation and for building competitive advantages.

Gaining a competitive edge through sustainable transformation:

- Reduce costs in the long term through process optimisation

- Strengthen innovation and growth

- Improve risk management

- Improve brand perception and reputation

Getting started: How to conduct a materiality assessment

Companies have a relatively large amount of freedom when it comes to how they conduct their materiality assessment. As of now, the EU has not yet issued any specific guidelines on how the assessment should be carried out. It is important, however, that companies explain how it was conducted in their CSRD report.

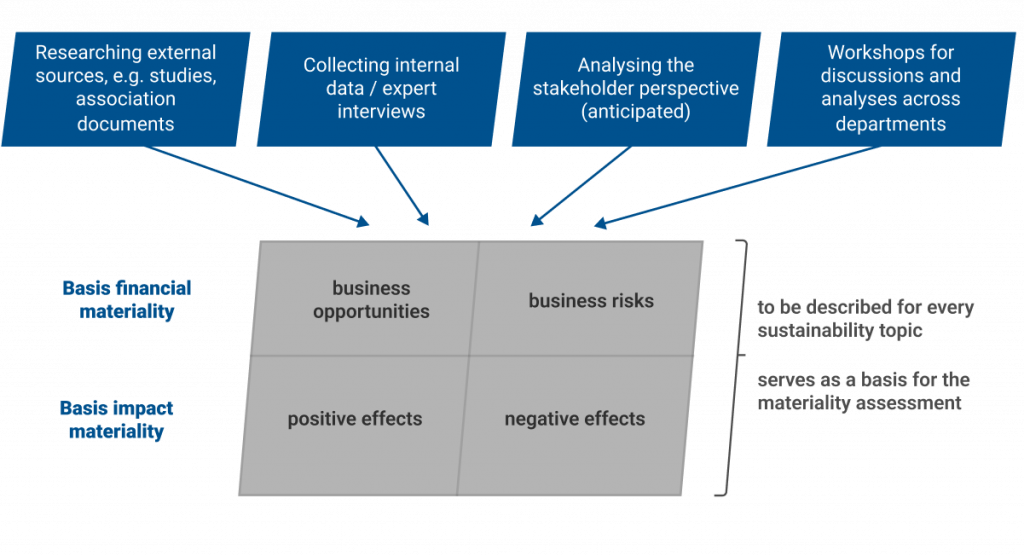

First, you should familiarise yourself with the list of sustainability topics. This can be found in ESRS 1 in Appendix AR 16. Assessing these topics should be done with the concept of double materiality in mind. The process involves gathering internal data, conducting interviews with stakeholders and experts, and referencing external sources, including studies.

It is important to have more than just a few people involved in conducting the materiality assessment. Employees from different departments should be included from the beginning if a topic is relevant to them. This will result in a better overall picture and a more realistic assessment of the situation.

In our experience, it makes sense to avoid silo structures. To ensure a successful transformation process, it is crucial to involve all relevant employees in the materiality assessment.

When assessing sustainability issues, it is important to analyse not only internal processes, but also the business environment. This includes taking supply chains and business relationships into account, for example. When conducting the materiality assessment for the CSRD report, external stakeholders should therefore also be included in the interviews.

Each of the sustainability topics is considered and assessed from the impact materiality and financial materiality perspective.

When it comes to impact materiality, this part of the assessment focuses on how the company’s operations influence sustainability issues. The corporate environment, business relationships, stakeholders and the company’s own actions are taken into account. The resulting positive and negative effects are then assessed depending on their severity and likelihood of occurrence. The assessment focuses on both the company’s perspective and that of the relevant stakeholders.

Financial materiality is assessed by identifying business opportunities and risks for each sustainability topic. These are considered in the short, medium and long term. Just like with impact materiality, the external stakeholders’ perspective is taken into account as well as the company’s.

Using the CSRD materiality assessment as a basis for sustainable transformation

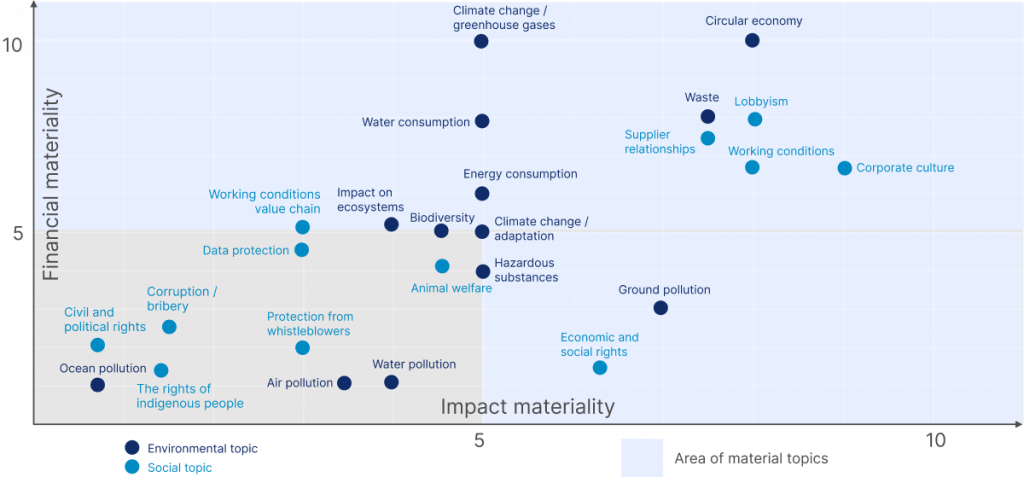

The results of the materiality assessment are presented in a materiality matrix. The topics classified as “material” can be easily identified in the two-dimensional coordinate system. In the assessment, each sustainability topic is given a score for financial materiality and impact materiality. This materiality matrix makes it easy to identify the topics that need to be addressed in the CSRD report.

What you achieve after completing the materiality assessment for your CSRD report:

- You have identified relevant sustainability topics.

- It is clearer which areas of action are important for your company.

- You are now in a position to set priorities and allocate limited budgets effectively.

- You have identified opportunities for action.

Conducting a materiality assessment enables your company to go beyond merely complying with CSRD regulations. With this assessment, you can identify potential areas for action as well as topics that come with high economic risk. You can then use these findings and integrate them into your business strategy to secure a decisive competitive advantage in the long term. We know from experience that the process is not always easy. That’s why we will guide you through all the steps involved in preparing the CSRD report and implementing transformation processes.

Christoph Auch

MANAGING PARTNER

christoph.auch@endure-consulting.com

+49 163 257 49 76

FAQ

What does double materiality mean in the materiality assessment?

Double materiality refers to assessing sustainability issues in terms of both their financial materiality (risks and opportunities for the company) and their impact materiality (effects on society and the environment).

How is the materiality assessment conducted?

The assessment includes analysing sustainability issues in line with ESRS 1, collecting internal data, conducting stakeholder and expert interviews and taking external sources into consideration. Having various departments meet for a thorough discussion is recommended.

What role do financial and impact materiality play in the materiality assessment?

Both aspects are crucial for assessing sustainability issues. Financial materiality looks at business risks and opportunities, while impact materiality analyses the company’s impact on the environment and society.

How does the materiality assessment contribute to a company’s business strategy?

By identifying where action can be taken as well as possibles risks, the assessment helps create a targeted and strategic plan that supports both sustainable and economic goals.

How are the results of the materiality assessment presented?

The results are presented in a materiality matrix where relevant topics are identified based on their assessment when it comes to financial and impact materiality.