An overview of the most important facts

- Double materiality integrates the financial materiality (impact of sustainability issues on the company) and the impact materiality (the company’s impact on the environment and society) in sustainability reporting.

- Sustainability topics are assessed on the basis of their relevance in terms of financial and impact materiality. Reportable topics are identified according to a point system.

- Understanding materiality leads to improved risk management, identification of business opportunities, initiation of transformation processes that lead to increased efficiency, cost reduction, better reputation, increased attractiveness for investors and a competitive advantage.

Double materiality: central concept of the CSRD

Sustainability is no longer just a buzzword, but a necessity in the modern business world. In the wake of growing awareness of environmental and social issues, reinforced by regulatory requirements such as the EU’s Corporate Sustainability Reporting Directive (CSRD), companies are faced with the challenge of adapting their business models and their way of reporting. A key concept of the CSRD is “double materiality”. This approach changes the way companies have to report on their impact on the world and the world’s impact on them.

What does “double materiality” mean in the context of the CSRD?

Double materiality in the context of the CSRD is a key concept in corporate sustainability reporting. It expands the traditional view of materiality in corporate reporting by integrating two perspectives:

- Financial materiality: Also known as the outside-in perspective, it focuses on the financial risks and opportunities that sustainability issues bring to a company. Short-, medium- and long-term impacts are assessed. The assessment is based on the probability of occurrence and the extent of the financial impact.

- Impact materiality: This perspective, also known as the inside-out perspective, looks at how a company’s activities influence the environment and society. The focus is on the company’s impact on external factors such as environmental pollution, social justice or employee welfare. The assessment is based on the probability and severity of the impact

The sustainability topics that must be taken into account regarding the double materiality concept are based on the ESG topics and are listed in detail in the ESRS standards and subdivided into smaller reporting topics. As part of the materiality assessment these topics are assessed according to their financial and impact materiality using a points system.

In practice, this means that companies must take both internal and external factors and stakeholders into account and explain how they address sustainability issues in their reports and what impact their business activities have. This requires a thorough analysis and assessment of the relevant issues as well as open and honest communication about the challenges and progress in these areas.

What is the significance of double materiality for companies?

The significance of double materiality for companies in the context of sustainability reporting is complex and has far-reaching implications. By evaluating sustainability issues according to financial and impact materiality, it is possible to recognise risks and opportunities early on.

Risk management & transformation capability

The concept of double materiality encourages companies to identify both internal (financial) and external (environmental and social) risks. This enables more comprehensive risk management. For example, environmental risks such as climate change or social risks such as labour conditions in the supply chain can be identified and assessed.

This holistic approach enables companies to recognise risks earlier and take active measures. This can mean, for example, making adjustments to the business strategy in order to respond to changing social expectations or environmental conditions. Thoroughly assessing sustainability issues according to the principle of double materiality can therefore improve risk management and a company’s ability to transform.

Identifying business opportunities

In addition to risks, the assessment also reveals opportunities. Companies are thus able to recognise where sustainable practices can lead to new business opportunities or can contribute to improving existing products and services or their development.

Assessing double materiality as a basis for transformation processes

The materiality assessment with the assessment of double materiality is a mandatory component of the CSRD. However, our recommendation is that this should not just be seen as a duty. The results provide deep insights into your own company by highlighting risks and opportunities. Use this knowledge to initiate transformation processes within the company. This can lead to various economic benefits.

- Increasing efficiency and reducing costs: Implementing sustainable processes can lead to more efficient use of resources and therefore to cost savings. For example, reducing energy consumption or waste can lower operating costs.

- Reputation and trust: Transparent reporting and commitment to sustainability issues strengthen trust among stakeholders, customers, investors and the public. This can have a positive impact on brand reputation and customer loyalty.

- Investment attractiveness: Investors are increasingly focusing on sustainability aspects. Companies that can credibly present their sustainability efforts become more attractive.

Companies that recognise and respond to sustainability risks and opportunities at an early stage can gain a competitive advantage. This can result in stronger market positioning, improved customer relationships or the development of new markets. Overall, the concept of double materiality not only helps companies to develop a more comprehensive understanding of their role in society and the environment, but also provides a basis for strategic decisions that can improve both sustainability and long-term economic performance.

Double materiality in practice: an example

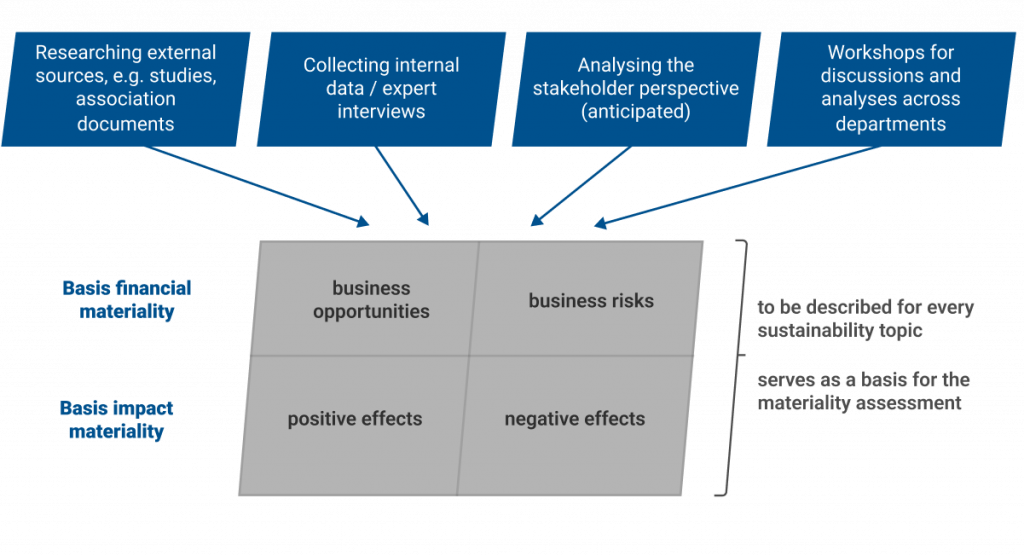

For the assessment of double materiality in the CSRD report, each sustainability topic listed in ESRS 1 is assessed according to financial and impact materiality. A wide variety of perspectives are considered, as shown in the following diagram. To give you a better understanding of the procedure, we provide an example of two topics being assessed for a company in the cosmetics industry.

Climate protection

For a cosmetics company, assessing financial materiality in the area of climate protection and CO2 emissions results in both business opportunities and risks:

| Opportunities | Risks |

|---|---|

| Developing new customer groups through sustainable products | The purchasing and consumption patterns of final consumers and merchants are progressively being shaped by carbon footprints. |

| Capitalising on higher willingness to pay for low-CO2 products | The attractiveness of products for employees is influenced by the carbon footprint and therefore also their attractiveness as an employer |

| Increased availability of raw materials, scarcity of raw materials and competitive pressure (e.g. due to the CO2 tax from 2024) |

Positive and negative effects are considered for impact materiality. In this case, only negative impacts are present:

- Environmentally harmful CO2 emissions are generated in the preliminary stages of production and extraction of raw materials.

- CO2 emissions are generated during the manufacture of products at two production sites.

- The international transportation of completed products results in the release of CO2 emissions.

- Most of the workforce drives to work.

- The product or its packaging contains parts derived from petroleum.

Once the impacts, opportunities and risks have been identified, they are assessed according to scope, severity and probability. In this case, the financial materiality has a lower influence than the impact materiality. This means there is great potential for transformation here.

Labour conditions in the value chain

Social aspects are also considered as part of the CSRD. Here is an example of how the topic of labour conditions in the value chain could be assessed for the cosmetics company.

Financial materiality:

| Opportunities | Risks |

|---|---|

| Transparency along the value chain can strengthen brand image and customer loyalty | Non-compliance with the legal framework of the Supply Chain Act due to lack of transparency |

| Partnerships and collaborations can strengthen relationships with suppliers and create new ones | Possible discontinuation of products |

| Improving transparency in purchasing decisions | Loss of partners |

| Rising manufacturing prices |

Impact materiality:

| Positive impacts | Negative impacts |

|---|---|

| Respect for human rights in accordance with international standards is laid down in the Code of Conduct | Labour conditions in the production of some raw materials are not known |

| There must be transparency regarding compliance with human rights |

The impact, opportunities and risks are also assessed here. In this case, both financial and impact materiality receive a medium rating.

Based on the assessment of the various sustainability topics, it is easy to identify which high-priority topics need to be addressed first once the materiality assessment has been completed. It is also easier to identify potential areas for action.

Summary: Double materiality as the basis for improved transformation capability

Double materiality is a core element of the CSRD and must be taken into account by all companies subject to reporting requirements in the materiality assessment. However, as you can see, a thorough analysis also holds a lot of potential. The assessment of materiality helps to recognise and leverage transformation potential. A comprehensive understanding of business risks can also be gained. This makes it possible to react at an early stage and avoid or at least mitigate the effects. If transformation processes are also initiated, this can result in a wide range of competitive advantages.

Christoph Auch

MANAGING PARTNER

christoph.auch@endure-consulting.com

+49 163 257 49 76

FAQ

What is meant by “double materiality” in the context of the CSRD?

”Double materiality” refers to two perspectives in sustainability reporting: financial materiality (outside-in perspective), which focuses on the financial risks and opportunities of sustainability issues for a company, and impact materiality (inside-out perspective), which looks at how a company’s activities affect the environment and society.

How is it determined whether a sustainability topic is reportable?

A sustainability topic is reportable if it is categorised as relevant from one of the two perspectives of double materiality – financial materiality or impact materiality. This assessment is based on a points system that takes into account the probability of occurrence and the severity of the impact.

What are the advantages of double materiality for companies?

The application of double materiality helps companies to recognise risks and opportunities at an early stage and respond to them. This leads to improved risk management, identification of business opportunities and can initiate transformation processes that lead to increased efficiency, cost reductions, a stronger reputation, increased investment attractiveness and competitive advantages.

How is double materiality applied in practice?

In practice, each sustainability issue is assessed according to its financial and impact materiality, taking various perspectives into account. The assessment includes analysing risks and opportunities as well as their scope and probability. This helps companies to set priorities and identify potential for action in order to effectively implement sustainability goals.